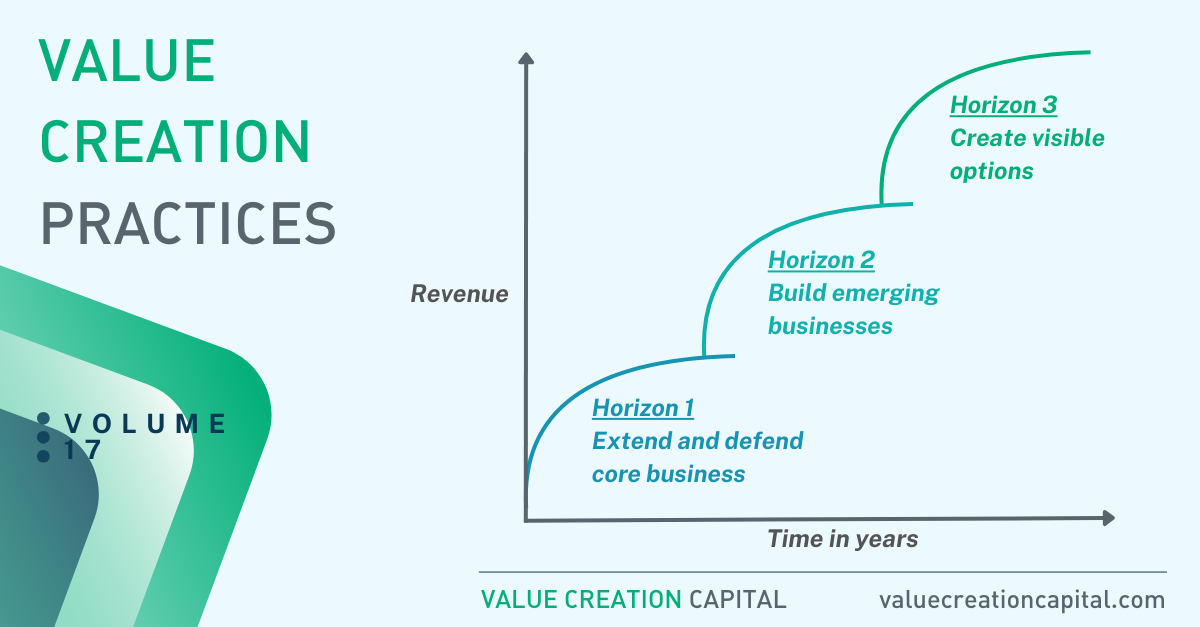

Three Horizons Model

I’m a big fan of Three Horizons Model. Originally, it was created by McKinsey in 2000 as a model for innovation strategy for corporates. It allowed senior management to visualize and support companies to execute existing business models while simultaneously creating new capabilities — and helped to prioritize innovation products and programs.

But is also a great tool for prioritizing new investments for late startups and scale ups.

Let me explain the model more in detail. The model is categorizing your business activities in three.

- Horizon 1 represents the core businesses that provides the greatest revenue and cash flow. Here is the focus on improving performance to maximize the value.

- Horizon 2 encompasses emerging opportunities, the core business for tomorrow. There is a product market fit, but it is lacking scale.

- Horizon 3 contains ideas for growth down the road—for instance pilot and research projects. But no product market fit yet.

Companies must manage businesses along all three horizons concurrently. Rather, it suggests the cycle by which businesses and ventures move, over time, from horizon two to horizon one, or from horizon three to horizon two. The y-axis represents the growth in value that companies may achieve by attending to all three horizons simultaneously.

For late startups and scaleups, it is advised to spend resources on all three business but in the right ratio. Companies that only spend time on horizon 1, will run out of steam over time. Scaleups that are too much involved in horizon 2 and 3, will eventually lose the right to grow their business.

The strength of the model is that is also a way of prioritizing your time and resources. It advised to spend your scarce resources in the following ratio:

- Horizon 1: 70-85%

- Horizon 2:10-20%

- Horizon 3: 5-10%